Scaling Agency Prospecting: Why Strategy Must Come Before Tools

How to build signal-based BD workflows without losing the strategic nuance that proves your expertise—from reactive outreach to 10-15% qualified reply rates

Your best BD people already know which signals indicate client need for your services.

They light up when a brand’s shift to Gen-Z audiences aligns with your social/gaming expertise. Or they spot when a Shopify POS partnership creates integration opportunities for retail experience work.

But they can’t manually monitor for these signals across 200 target accounts while also managing pipeline, writing proposals, and running presentations.

This is the bandwidth constraint that caps BD effectiveness—not lack of domain expertise, not poor positioning, but the operational challenge of scaling what your best people already do.

When solving this, agencies typically hit two dead ends:

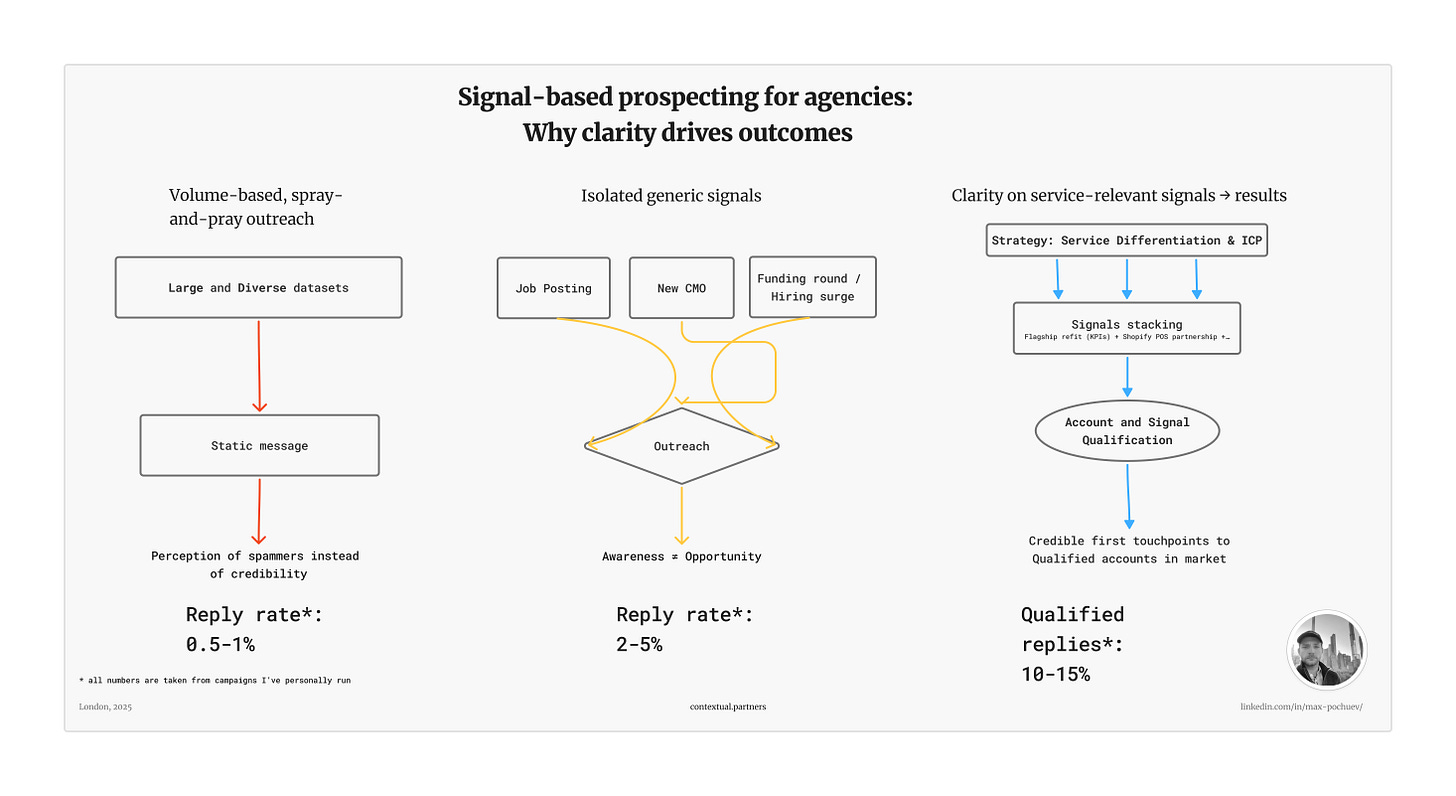

Outsourcing to BD agencies* who lack your domain expertise. They can’t tell you why a “strong IP brand entering a gaming franchise” matters differently to your studio than to an e-com CGI competitor, often defaulting to volume-based, spray-and-pray outreach.

Adopting one-size-fits-all tools built for SaaS GTM, not agency positioning. They track job changes and funding rounds—isolated generic signals that, when used alone, put you in a crowd of 20+ vendors competing on awareness, not relevance.

The old mantra “we just need to get them on a call and we can tailor our pitch” is breaking because buyers expect credible, relevant messaging already in the first touchpoint—they won’t research your website to figure out if you’re relevant (like people used to).

So the question is: how do you make signal-based prospecting systematic and scalable without losing the strategic nuance that makes it effective?

This post kicks off a series on how agency leaders can scale good prospecting whilst making it more effective and aligned with their in-house strategy and positioning.

Today we break down the foundation: what signals actually matter for agency GTM, how to qualify them against your specific positioning, and why this layer can’t be separated from your agency strategy.

*Note: When I refer to BD agencies here, I mean outsourcing cold outreach and top-of-funnel prospecting whilst treating these relationships as just “adding scale.” In other circumstances—like outreach following PR coverage—these partnerships can add significant value.

Why Signal Relevance Starts With Strategy Clarity

Signal-based workflows are a great place to start when you want breadth on discovery and improved targeting quality without necessarily changing your drafting process.

Most BD challenges for agencies are strategic translation problems.

Your agency has positioning. You know your differentiation, your proof points, the verticals where you win. But translating “we specialise in data-driven retail activations” into which accounts to target, when to reach out, and what angle to lead with requires a layer of strategic context that generic BD approaches can’t access.

Here’s where it breaks:

Isolated generic signals (new CMO, funding round, job posting) put you in awareness plays. Personalisation based on these signals may make prospects spend more time reading your email—even reply with a polite “no thank you”—but actual conversion rates stay low because the signal doesn’t indicate need for your specific services.

Relevant buying signals (e.g., a retailer launches a flagship refit with dwell-time and omni-channel share KPIs) let you enter as a domain expert responding to expressed need. You’re not pitching—you’re demonstrating you already understand their challenge and can help.

Here are some stats from my recent activations:

Reply rates: 2-4% with generic signals vs. 10-15% with domain-specific signals

Qualification: 15-20% of generic replies are worth pursuing vs. 60%+ with relevant signals

Your best BD people can identify these signals because they understand your positioning and differentiation deeply.

This strategic layer—knowing which signals prove your specific value—can’t be outsourced or automated away. But the manual monitoring, research, and qualification work that follows can be systematised.

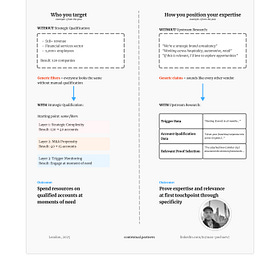

That’s the unlock: clarity on what signals matter (strategy) + infrastructure to catch and act on them systematically (workflow).

Signal Spotting: The Foundation Layer

Buying signals surface constantly across industries. The question is which ones actually indicate relevance to your agency’s positioning.

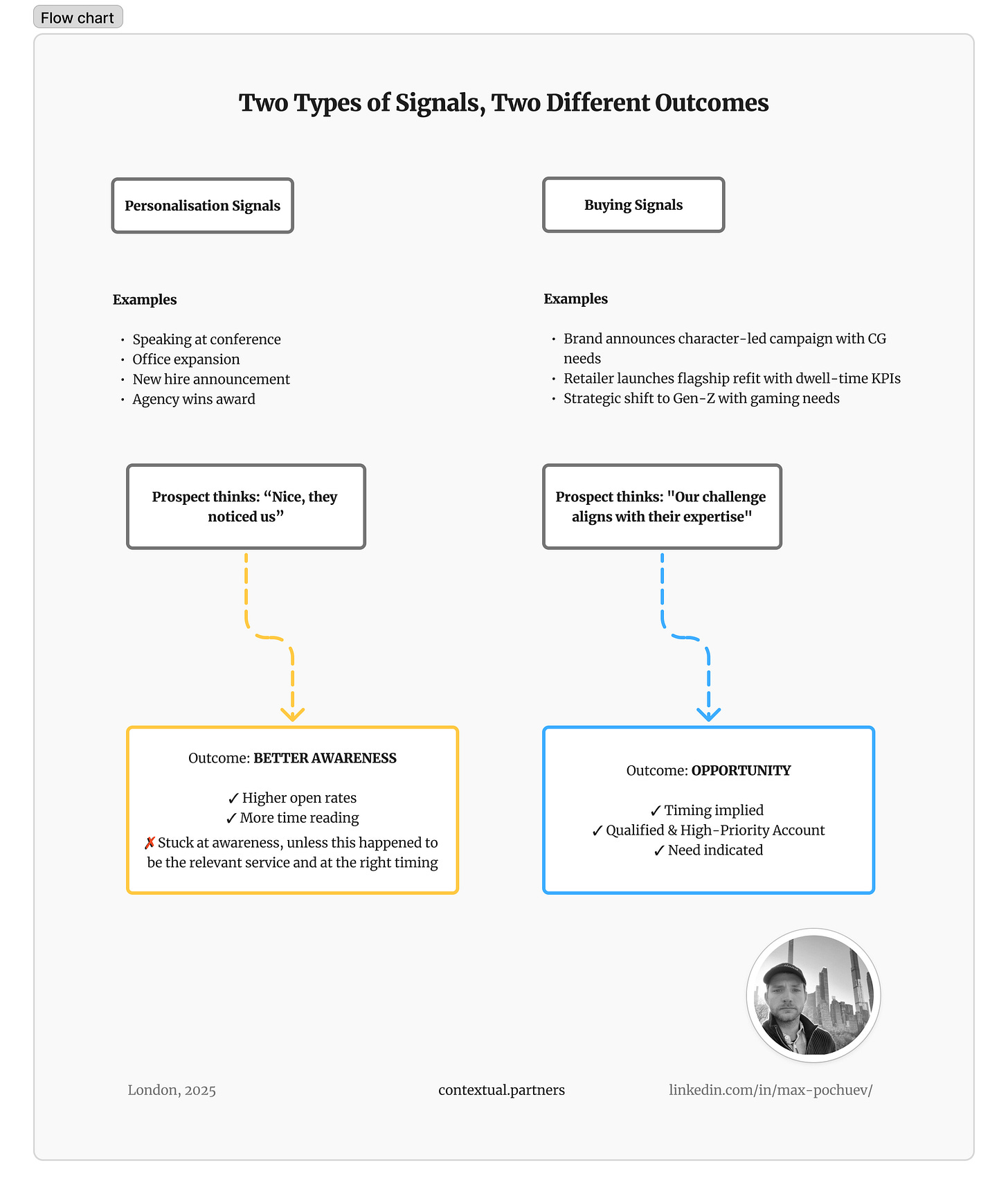

In the agency context, I think of signals in two categories:

Buying signals: The account is in-market for your services or your specialisation is newly relevant

Personalisation signals: Allow 1-to-1 customisation (e.g., an agency wins an award and you mention it)

Personalisation improves open rates, but buying signals drive conversion. If you mention an award but your expertise isn’t relevant to the account’s current needs, you’re stuck at awareness.

Relevant buying signals let you prioritise accounts where your positioning creates advantage—and reach them when need is emerging, not after they’ve engaged other vendors.

Here’s what this looks like for different agency profiles:

1) Production Studios (VFX / CGI / Post)

Tier 1 — Differentiated

Signal: Brand announces a character-led campaign with explicit CG mentions

Where: Brand newsroom; agency PR; Adweek/shots

Why it fits: Direct CG/VFX need; continuity + scope control is your moat

Tier 2 — Contextual

Signal: Creative agency wins a new account in a vertical you’ve delivered heavily for

Where: Trades; agency LinkedIn; client PR

Why it fits: New agency-of-record needs reliable executional partners in that vertical; you have relevant, named proof

Tier 3 — Generic (requires qualification & stacking)

Signal: Spike in CGI artist job posts (no specific tech)

Where: LinkedIn Jobs; Mandy; Staff Me Up

Why it fits: Indicates upcoming CG volume, but broad on its own

2) Brand Experience Agency (Events / Retail)

Tier 1 — Differentiated

Signal: Flagship store refit announcement with explicit KPIs (app sign-ups, membership, dwell-time) that match your specialism

Where: Brand newsroom; earnings deck

Why it fits: KPI-driven brief aligns with your “big moment → measurable outcome” expertise

Tier 2 — Contextual

Signal: Partnership PR — Brand × Snap AR / Shopify POS / Niantic

Where: Partner press rooms; dev blogs

Why it fits: Integration challenge you’ve solved before (AR ↔ POS, tracking, analytics)

Tier 3 — Generic (requires qualification & stacking)

Signal: Participation in a major exhibition/trade-fair (e.g., Salone del Mobile)

Where: Event site; sponsor lists; brand PR

Why it fits: Implies content + experience needs

3) Brand / Strategy Agencies

Tier 1 — Differentiated

Signal: Market expansion or brand shift to Gen-Z where you have social/gaming expertise

Where: Brand newsroom; investor deck; product line updates

Why it fits: Clear service–market match; you bring relevant playbooks/case proof

Tier 2 — Contextual

Signal: End of current tenure of a competitor agency that’s different in USP & positioning

Where: Trades; procurement timelines; pitch gossip

Why it fits: Window for new partners; you can position as de-risked continuity + sharper POV

Tier 3 — Generic (requires qualification & stacking)

Signal: New CMO/CSO appointment

Where: LinkedIn; brand newsroom

Why it fits: Often signals narrative refresh; broad alone

Signal effectiveness is always tied to your agency strategy and how differentiated these signals are.

Tier 1 signals are tightly connected to your core service differentiation—spotting them proves domain expertise

Tier 3 signals are broad; the stakeholder has likely received 10 pitches this morning from various vendors

The combination of strategic clarity (what signals indicate need for our services) and workflow infrastructure (systematically catching and acting on them) is what moves you from competing on awareness to competing on relevance.

This strategic layer is why off-the-shelf BD tools built for SaaS don’t translate to agency GTM—they can’t encode what makes your positioning different.

From Signals to Qualified Opportunities: The Framework

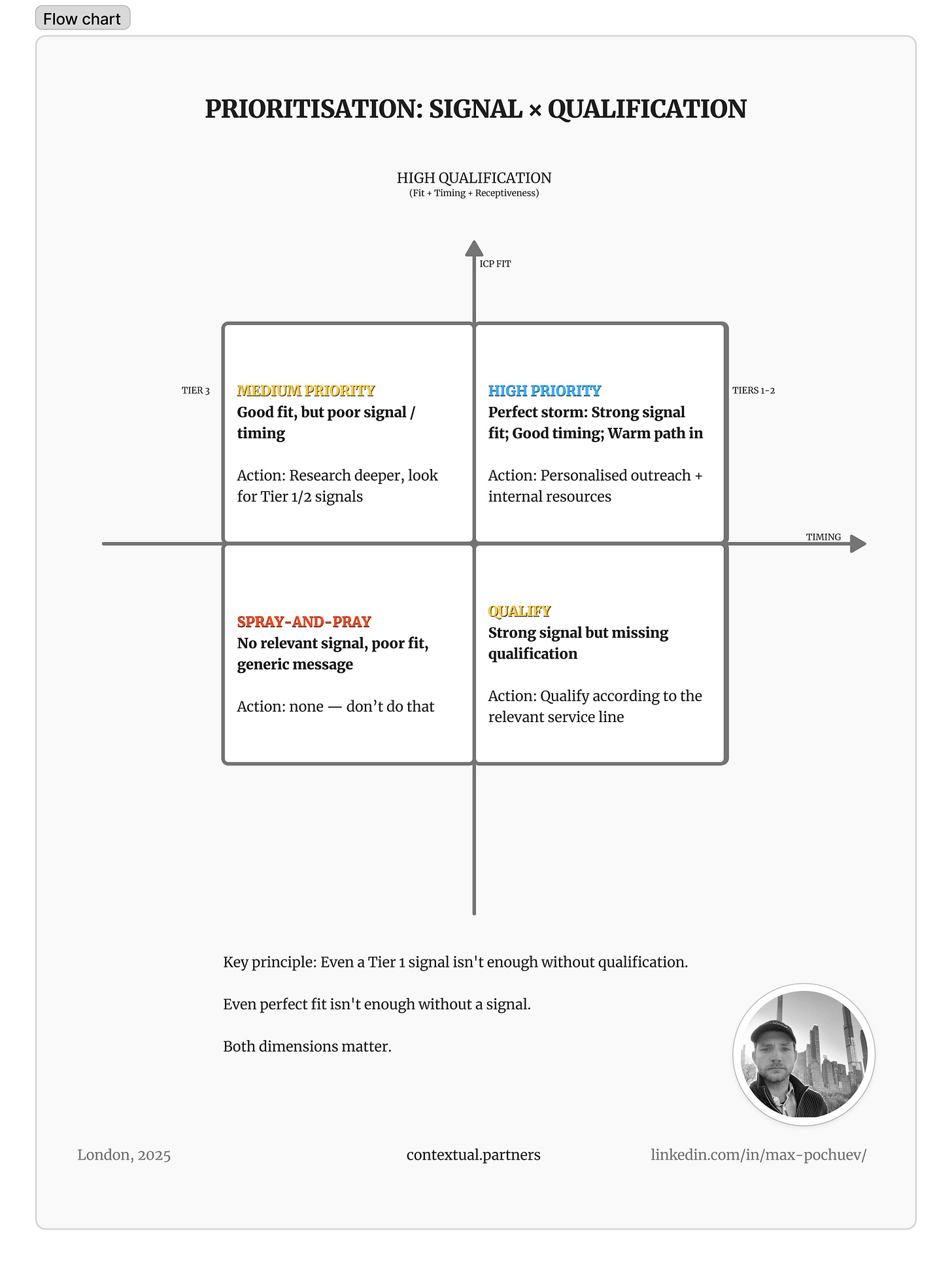

A signal—even a strong Tier 1 signal—tells you there’s potential relevance. But BD decisions require more: Is this the right account? Is timing aligned? Should we prioritise internal resources for winning this one over other opportunities?

This is where qualification layers become critical. Multiple signals and qualification criteria compound confidence and help you separate high-priority targets from noise.

The Qualification Framework

Different inputs serve different purposes:

Buying signals (Tier 1-3): Indicate potential need for your services

Account qualification: Confirms fit with your ICP (budget/authority, sector, scale, value network)

Timing indicators: Windows of opportunity (contract cycles, initiative launches, leadership changes)

Receptiveness signals: Additional opportunities to prove expertise (e.g., someone you’ve worked with before)

Strong opportunities have multiple layers aligned.

Simplified Example: Brand Experience Agency

You specialise in retail activations with analytics and measurement capability.

Scenario A: Single Tier 3 Signal

Signal: New VP of Retail Experience hired

Decision: Monitor, possibly nurture long-term

Priority: Low

Scenario B: Qualified Opportunity

Buying signal (Tier 2): Brand announces Shopify POS partnership

Account qualification: 50+ retail locations; matches ICP

Timing: Tech investment suggests active initiative; current agency contract ending Q4

Receptiveness: New VP from brand where you’ve worked; LinkedIn activity shows exploration

Decision: Immediate outreach with stakeholder-specific angle referencing POS integration, analytics-driven activations, and relevant proof from their previous brand.

Priority: Top tier

This is where strategic clarity becomes operational: Your agency’s positioning defines what “qualified” means. A qualified account for a VFX studio with Unreal Engine specialisation looks different from one focused on character design.

This strategic context—what signals matter, how to weight them, which accounts are genuinely in-market—can’t be outsourced. It requires your domain expertise: what’s worked historically, where your case studies create advantage, how your positioning differentiates you.

But once that strategic layer is defined, the systematic application of these criteria across hundreds of accounts can be workflow-enabled.

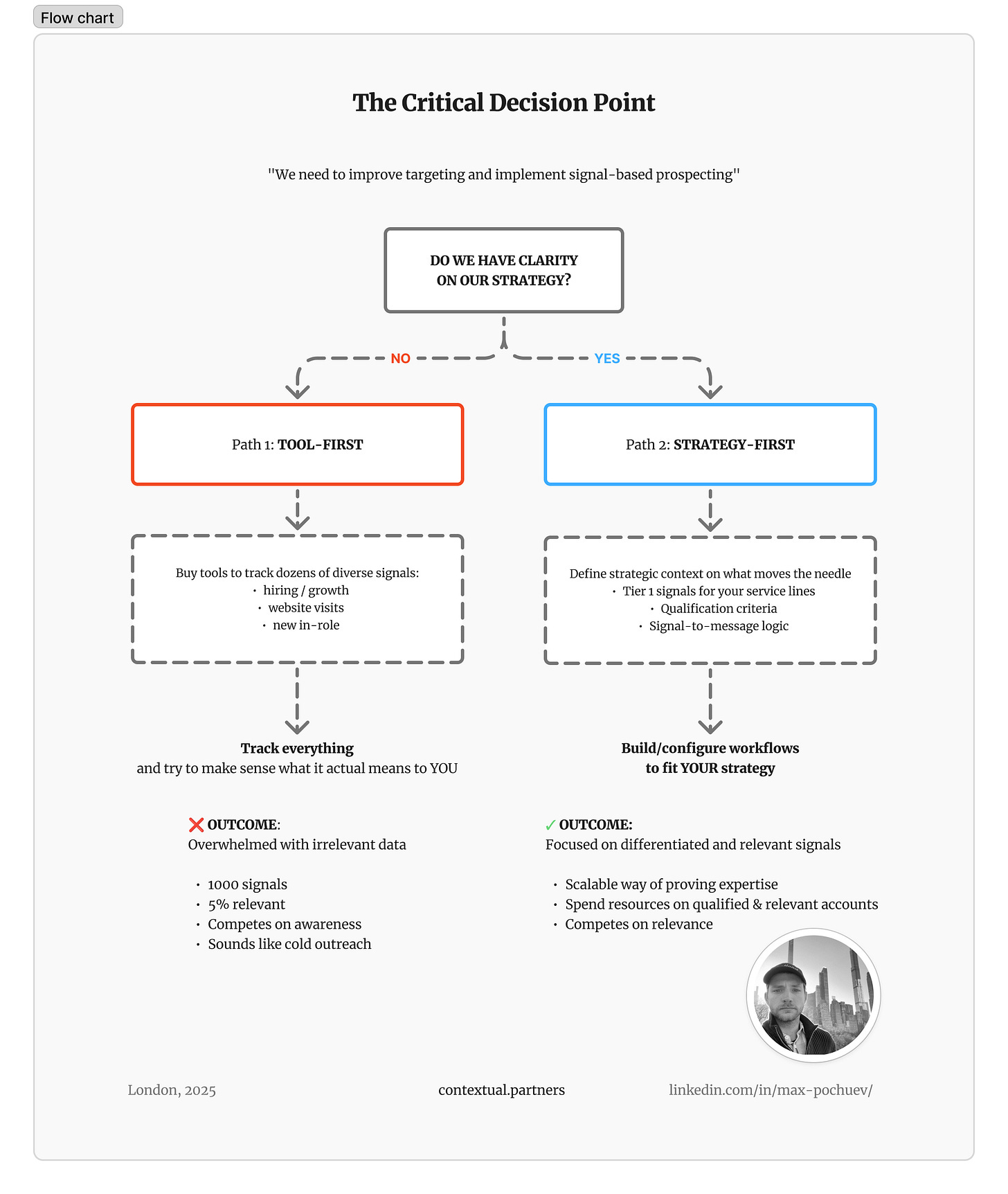

Building the System: Where Strategy Leads Tech

Signal-based prospecting breaks when agencies try to scale it manually or adopt tools that don’t account for their strategic context and established processes / channels.

Here’s the fundamental challenge: The tool can’t tell you what signals matter. You can automate monitoring for “new CMO appointments,” but if that signal doesn’t indicate need for your services, you’ve just systematised noise and you’re stuck competing on awareness with dozens of other vendors.

The Strategic Layer Comes First

Before investing in monitoring infrastructure or workflow tools, you need clarity on:

What does a Tier 1 signal look like for each of our service lines?

Which qualification criteria separate good-fit accounts from distractions?

How do we connect each signal type to our proven capabilities in messaging?

This strategic work requires your domain expertise—what’s worked historically, where your case studies create advantage, how your positioning differentiates against competitors, how your target clients prefer to buy.

Only when this strategic context is clear should you look into the tech that can make the process systematic and scalable. Without it, tools just add another drop in the sea of noise and erode your credibility.

Where Tools Fit

Tier 1 (Differentiated) signals often require custom setup, monitoring, and qualification because they’re unique to your positioning:

Brand newsrooms, agency press pages, trade publications (RSS/alerts)

Industry communities where deals get discussed

Platform-specific sources (e.g., Shopify partner directory if you do integration work)

Tier 2 (Contextual) signals appear in more structured places and require manual / AI powered transcription:

LinkedIn Sales Navigator for job changes, company updates

Trade press aggregators (Campaign, Marketing Week, Adweek)

CRM alerts for news on target accounts

Tier 3 (Generic) signals are easiest to automate with standard tools:

LinkedIn Sales Navigator, ZoomInfo, Apollo for company changes

Job boards for hiring signals

The principle: Tools aggregate signals. Your strategy determines which ones matter and how to qualify them.

Implementation Considerations

Most agencies should start simple:

Define Tier 1/2 signals for your service offerings

Set up basic monitoring (RSS, LinkedIn, trade press) — next post in this series (link below)

Build a qualification checklist / AI workflow — link to the post about this below

Test with 20-30 target accounts before scaling

The goal isn’t end-to-end automation from day one. It’s moving from reactive/opportunistic prospecting to systematic signal intelligence that reflects your domain expertise—even if it means manual qualification at first.

This is also why bespoke workflow design matters—your team structure, ICP, and strategic priorities are unique. One-size-fits-all campaign builders don’t account for the nuance that makes agency BD effective.

What’s Next in This Series

This post focused on the foundation: what signals matter, how to qualify them against your strategy, and why this layer requires strategic clarity that can’t be outsourced.

But operationalising this at scale involves additional layers:

Coming up:

Signal monitoring infrastructure: Practical playbooks for tools, workflows, and aggregation systems that make signal tracking systematic without requiring manual daily monitoring — link below.

Signal-to-message translation: How to take qualified signals and systematically build stakeholder-specific messaging that connects your positioning to their context — link below.

Implementation and resourcing: How to build this capability within existing BD teams, timelines for different complexity levels, and when custom workflows make sense vs. off-the-shelf tools

UPDATE: In my new post, I talk about how you can bring this thinking to life with setting up account & signal qualification, and signal to message-translation:

From Strategy to Actual Prospecting: How AI Workflows Operationalise Targeting and Messaging

Every BD leader wants their team to be more strategic and systematic in proactive growth. But most strategic initiatives don’t make it beyond leadership meetings because teams can’t systematically prioritise accounts based on strategic criteria and triggers.

The principle stays consistent: Strategy and domain expertise stay in-house. Workflow infrastructure makes it scalable.

If you’re a growth leader at a B2B agency or strategic partner trying to move from reactive BD or high-volume/low-conversion outbound to systematic, high-quality prospecting—this is the starting point. Clarity on what signals prove your value. Everything else builds from there.