From Strategy to Actual Prospecting: How AI Workflows Operationalise Targeting and Messaging

Every BD leader wants their team to be more strategic and systematic in proactive growth. But most strategic initiatives don’t make it beyond leadership meetings because teams can’t systematically prioritise accounts based on strategic criteria and triggers.

In the previous post, we established the foundation: defining bespoke signals that indicate genuine need for your expertise. That strategic clarity is the vital first step. But what ultimately matters is making this strategy operational—translating intent into systematic workflows that determine who your team targets and when.

This shift is increasingly important. Channel saturation and changing buyer behaviour make generic spray-and-pray outreach ineffective for complex services. Across the agencies I work with, strategic targeting and messaging moves reply rates from 1-2% (across all accounts) to 10-15% (for target accounts).

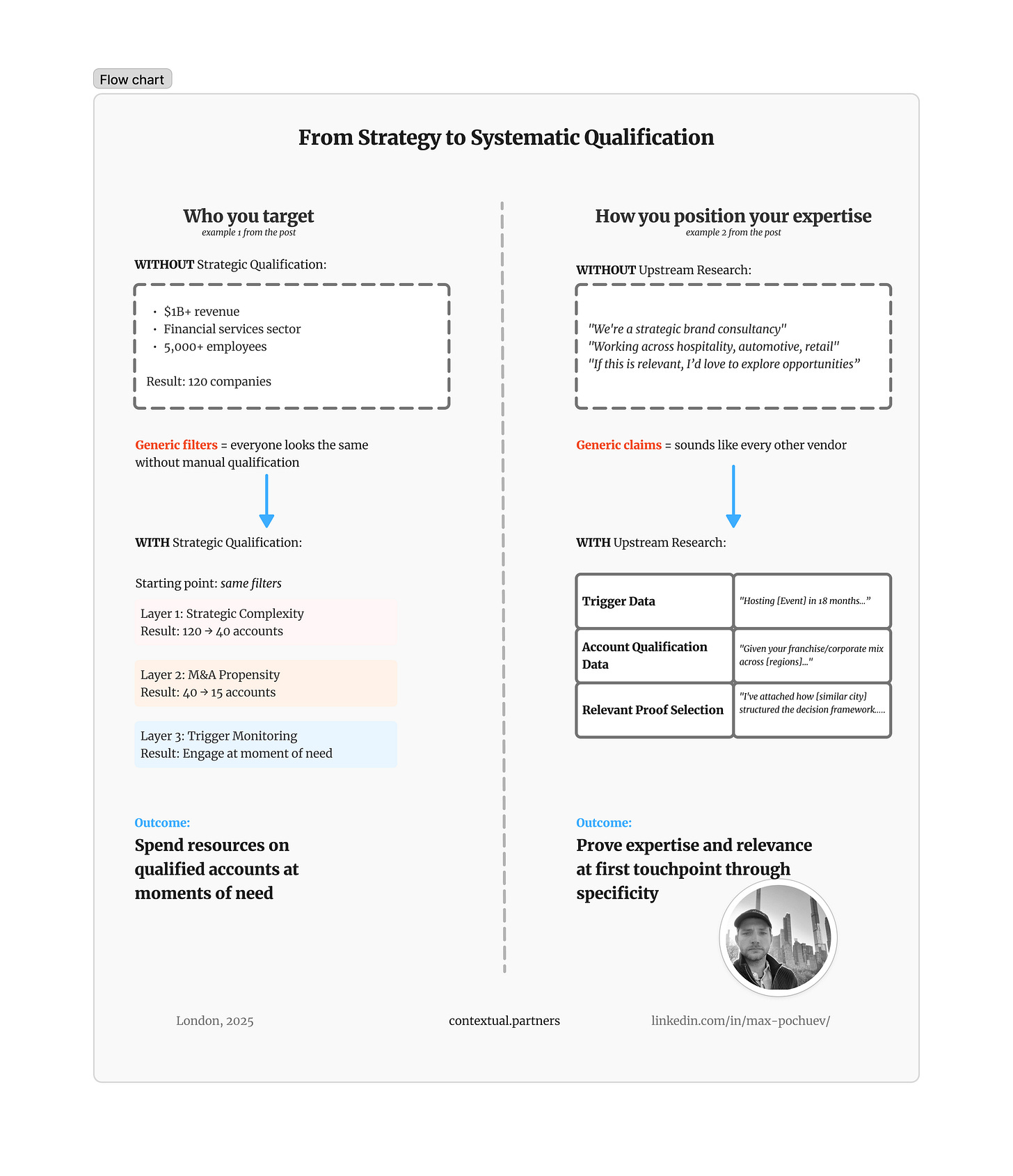

The bottleneck has always been that firmographic criteria (size, location, sector) are baselines, not indicators of genuine need. But with AI-powered qualification workflows built on criteria specific to your positioning, you can systematically move from 120 accounts matching generic filters to 15 high-priority accounts worth your resources—and transform what you can say to prove expertise at first touchpoint.

Today I’ll show you how this works through two agency examples: how strategic qualification determines who you target, and how upstream research enables messaging that demonstrates understanding of their specific challenges and proves your expertise before the call.

Catching and Analysing Strategic Signals → Triggers

Let me show you how this works in practice with an M&A and transition branding agency—comparing two approaches to the same market.

The agency serves organisations with complex multi-brand portfolios navigating corporate transitions—M&A, IPOs, carve-outs, spin-offs—in highly regulated industries like financial services, healthcare, and insurance.

Their challenge: Large companies exist continuously, but only need transition branding during specific corporate events. And only a fraction operate with the portfolio complexity and regulatory constraints that make brand architecture a board-level decision—not just a marketing exercise.

Approach 1: Spray-and-Pray

Starting point: Sales Navigator filters

Companies with $1B+ revenue / 5,000+ employees

Sector filters: Financial services, healthcare, insurance

These criteria are generic—they don’t reflect who genuinely needs sophisticated brand architecture.

The problem: Manual qualification for criteria that actually matter (multi-brand portfolio structure, M&A frequency, corp dev team sophistication) consumes senior BD time and can’t scale. High-volume lists include companies that might do M&A someday—but most aren’t in active transition, and some will never be in-market because they lack portfolio complexity. Messaging gets watered down to avoid sounding irrelevant.

The blind spot: Static filters can’t distinguish between a company with 248 acquisitions and a sophisticated 9-person corporate development team versus one with a single historical acquisition and no M&A function. Both pass the same criteria, but their transition branding needs—and purchase timing—are completely different.

Approach 2: Strategy-Led Qualification

After aligning internally on what makes transitions strategic versus operational for their positioning, this agency built a systematic qualification process.

Stage 1: Strategic Complexity Qualification

Starting with the same 120 companies from Sales Navigator, AI workflows analyse information from their org websites and third-party sources for criteria that actually indicate need for sophisticated brand architecture:

Multi-brand portfolio structure (subsidiaries, not just service lines)

International operations (cross-border regulatory complexity)

Regulated industry presence (where brand integration faces compliance scrutiny)

Result: 46 priority accounts where corporate transitions would be strategic, board-level decisions—not simple rebrands.

Below is a demonstration workflow built in Clay (clay.com) showing how this qualification process works in practice. For clarity, I’ve focused on the core logic—production versions would include additional validation steps and data sources, but this captures the essential qualification framework.

Set the playback speed to 1.25x.

Stage 2: M&A Propensity Assessment

46 strategically complex accounts is better targeting. But the agency wants accounts that systematically execute complex transitions.

Enrichment from Crunchbase and LinkedIn assesses:

Acquisition history (count and pattern)

Corporate development organisation (team size, seniority, specialisation)

The differentiation:

One major insurer: 248 acquisitions + sophisticated 9-person corp dev team led by SVP = systematic acquirer (6/6 M&A propensity)

Another major insurer: 1 acquisition + no visible corp dev team = selective/opportunistic (1/6 M&A propensity)

Same industry. Similar scale. Massively different transition branding needs and purchase timing.

Result: 15 high-propensity accounts with proven M&A programs worth monitoring.

Set the playback speed to 1.25x.

Stage 3: Trigger Monitoring

For those 15 accounts, automated monitoring tracks M&A announcements—acquisitions, mergers, carve-outs, IPO filings. When a qualified trigger fires, the BD team receives company name, transaction details, timeline, and identified corporate development stakeholders (name, title, LinkedIn profile).

Set the playback speed to 1.25x.

The strategic shift: From “5,000 financial services companies over $1B revenue” to “15 companies with proven M&A programs and sophisticated brand architecture needs—here’s the corp dev leader to contact when they announce their next acquisition.”

The qualification doesn’t just improve targeting quality—it transforms what’s operationally possible. Systematically monitoring 46 strategically complex accounts for transaction triggers is realistic; manually tracking 5,000 companies for M&A news is impossible.

This is where strategic clarity becomes operational infrastructure. No research workflow adds value if built on principles misaligned with how the market perceives your expertise. But once that strategic layer is defined, systematic qualification stops being a bandwidth constraint and becomes a competitive advantage.

From Generic Templates to Strategic Messaging

Section 1 showed how strategic qualification identifies which accounts to target and when. Now let’s explore how that upstream qualification transforms messaging.

Think of a brand and design consultancy specialising in strategic brand transformation. Their ideal clients are legacy organisations repositioning for premium markets AND brands undergoing transformation moments across hospitality, automotive, healthcare, and retail.

Their challenge: Making their expertise relevant to each specific vertical and pain point. A hospitality group acquiring premium properties faces different brand architecture challenges than an automotive manufacturer transitioning to electric—even though both need strategic brand transformation.

Approach 1: The Generic Template

When uncertain about relevance, agencies hedge:

Hi [First name],

Hope you’re well.

We’re a strategic brand consultancy working with organisations across hospitality, automotive, and retail on brand transformation and visual identity systems.

Our work spans portfolio brand architecture to positioning strategies for organisations entering new markets or repositioning for different customer segments.

We’ve delivered projects for [Client A], [Client B], and [Client C], and I think there could be interesting opportunities to collaborate.

Would you be open to a 30-minute conversation to explore how we might support your team?

Best regards,

Vague service descriptions, multi-industry mentions without specificity, unrelated client name-drops. The “could be”, “might support”, “explore opportunities” language signals uncertainty about relevance.

\This isn’t a semantic or tone-of-voice issue—the need to hedge comes from genuine uncertainty about what’s relevant to the given account.

Approach 2: Qualification-Enabled Messaging

After implementing trigger monitoring and qualification, they target specific moments where their positioning creates advantage:

Cities selected to host major international events

Hospitality groups acquiring premium properties

Automotive manufacturers transitioning product lines

Heritage retailers repositioning from mass-market to premium

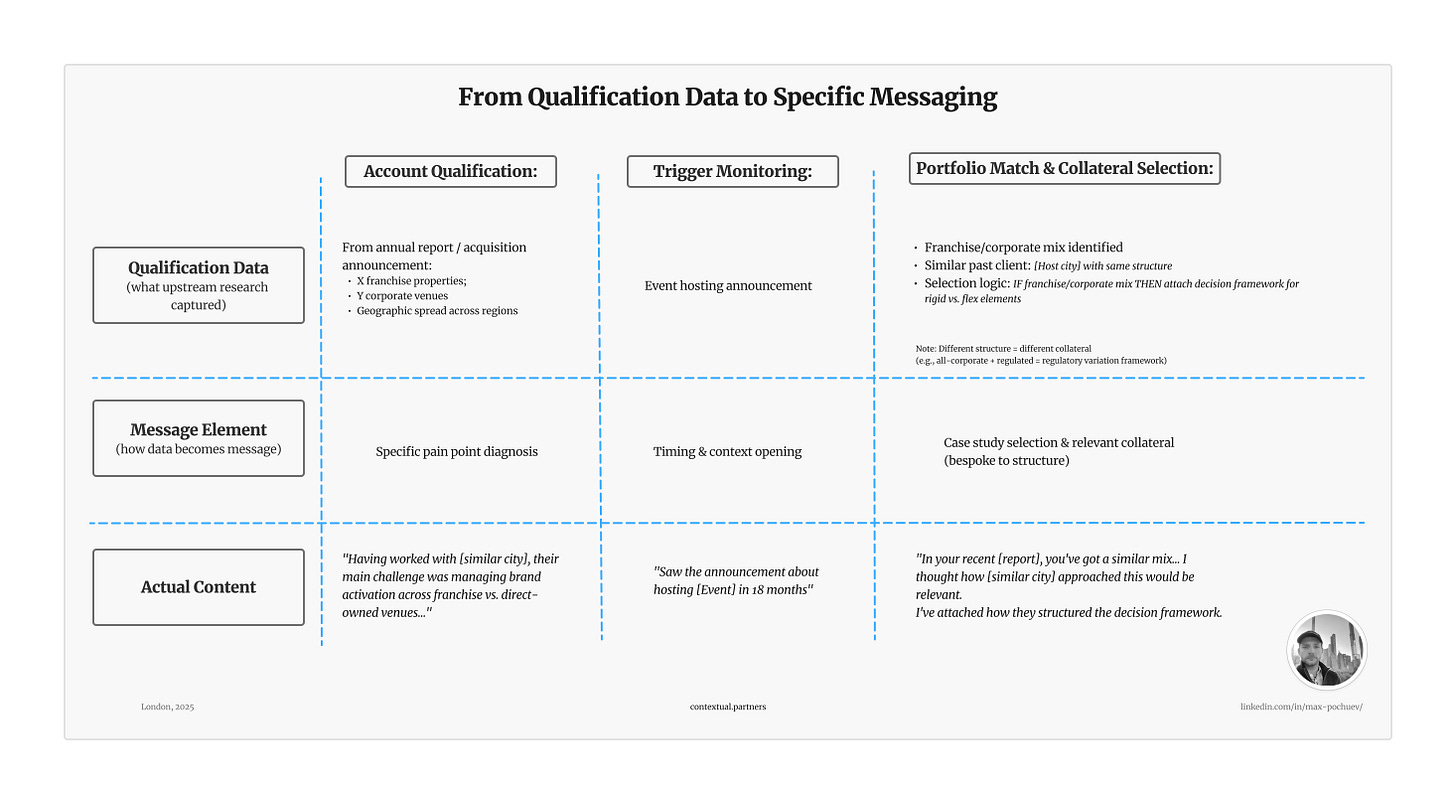

When a trigger fires, qualification data becomes the building blocks for specific messaging.

1. Specific diagnosis instead of generic claims

Generic: “Our work spans brand architecture to positioning strategies”

Qualified: “Saw the announcement about hosting [Event] in 18 months. Having worked with [similar host city], their main challenge was managing brand activation across franchise vs. direct-owned venues—the Games brand requirements were the same, but their franchise operators needed local flexibility that their corporate venues didn’t.

In your recent [annual report/acquisition announcement], you’ve got a similar mix with [X franchise properties] and [Y corporate venues] across [regions], and I thought how [similar city] approached this would be relevant.

I’ve attached how they structured the decision framework for what stays rigid vs. what flexes. If this resonates with where you’re heading, I’d be happy to share more details.”

The diagnosis combines trigger data (event announcement, timeline) with qualification insights (portfolio complexity, ownership structure, geographic scope). This proves understanding of why THIS organisation specifically needs sophisticated brand architecture—not just that an event is happening.

2. Vertical-specific proof instead of generic name-drops

Generic: “We’ve delivered projects for [Client A], [Client B], and [Client C]”

Qualified: “We worked with [similar host city] through [previous event]. Given your franchise/corporate venue mix, the approach they took on managing brand consistency across different ownership models might be directly relevant—particularly how they structured what stayed rigid versus what could flex locally.

The franchise operators got clear brand guardrails but enough flexibility to activate without constant approval loops. Your [Y corporate venues] would work differently—tighter control, direct rollout.

I’ve attached a breakdown of their decision framework for what elements were centrally controlled versus locally adapted. If the franchise/corporate balance is something you’re working through for [Event], happy to discuss how those principles would apply to your setup.”

Why this specific case study detail: The upstream qualification revealed their portfolio combines franchise properties with corporate venues. A different organisation—say, all corporate-owned venues across regulated markets—would receive different collateral: how [similar city] navigated regulatory approval variations while maintaining brand consistency. Same case study project, different attachment, based on what account qualification surfaced about their operational structure.

3. Value-add collateral instead of meeting requests

Generic: “Would you be open to a conversation to explore how we might support your team?”

Qualified: “I’ve attached how [similar host city] approached brand system design for [specific challenge relevant to your context]. Would it be useful to discuss how those principles apply to your timeline?”

The strategic shift: When qualification confirms which transformation moment and vertical-specific challenges apply, messaging proves understanding at first touchpoint. For agencies where project context varies dramatically, upstream qualification solves the portfolio problem: you know which expertise and proof point to lead with before outreach, not after a discovery call.

The qualification work—identifying triggers, researching context, selecting case studies—becomes systematic. BDs add their voice, but the research-to-message translation that normally consumes hours per account is now enabled by upstream qualification data.

The mechanics of translating qualification data into message elements—including where automation ends and BD’s craft begins—will be covered in the next post.

Making Strategic Qualification Operational

The examples in this post demonstrate what becomes possible when strategic intent translates into systematic workflows. But this shift from spray-and-pray to strategic, systematic prospecting requires real investment.

What This Requires

1. Strategic clarity and internal alignment

Who benefits most from our expertise? What signals indicate they need us? Which qualification criteria separate genuine fit from noise?

2. Learning to translate strategy into operational workflows

What databases contain the signals that matter for your services? How do you systematically monitor for triggers? How do you structure enrichment logic that reflects your strategic criteria? This requires building new operational capabilities.

3. Understanding data limitations

Some signals can’t be systematically caught. Some qualification criteria require human judgment. Testing reveals what can be automated versus what remains manual.

4. Tool evaluation and technical capability

Different tools fit different strategies. More advanced workflows require automation experience. Teams either build this capability internally or work with partners who understand agency positioning AND workflow design.

5. Maintaining strategic foundation

A workflow not grounded in clarity about who values your expertise will produce marginally better results than basic firmographic criteria. The sophistication is in the strategic logic, not the automation itself.

Why This Investment Matters

Generic outreach is not cutting through the noise. Strategic qualification at moments when accounts are in-market is becoming table stakes for proactive growth. The shift from 1-2% reply rates to 10-15% engagement—prospecting as resource drain versus growth engine—justifies the investment.

What’s Next in This Series

How do you integrate these workflows into your existing team structure and capabilities?

The next post explores this through agencies with different team sizes, technical capabilities, and GTM strategies. We’ll cover where existing BD skills apply, where new capabilities need building, and how to phase implementation based on your bandwidth.

This bespoke approach—building workflows around your strategy, team structure, and value network rather than adapting to generic sales tech—is what separates systematic strategic qualification from just adopting another tool.

For growth leaders ready to move beyond spray-and-pray: the foundation is strategic clarity on what signals prove your value. Everything else serves that strategic layer.