Focusing on Accounts That Have Genuine Need in Your Agency's Expertise

You know exactly what strategic complexity, organisational maturity, and business context separates companies who would value your expertise from those who wouldn’t.

But translating that strategic clarity into systematic business development is where most agencies hit a wall in their proactive growth initiatives.

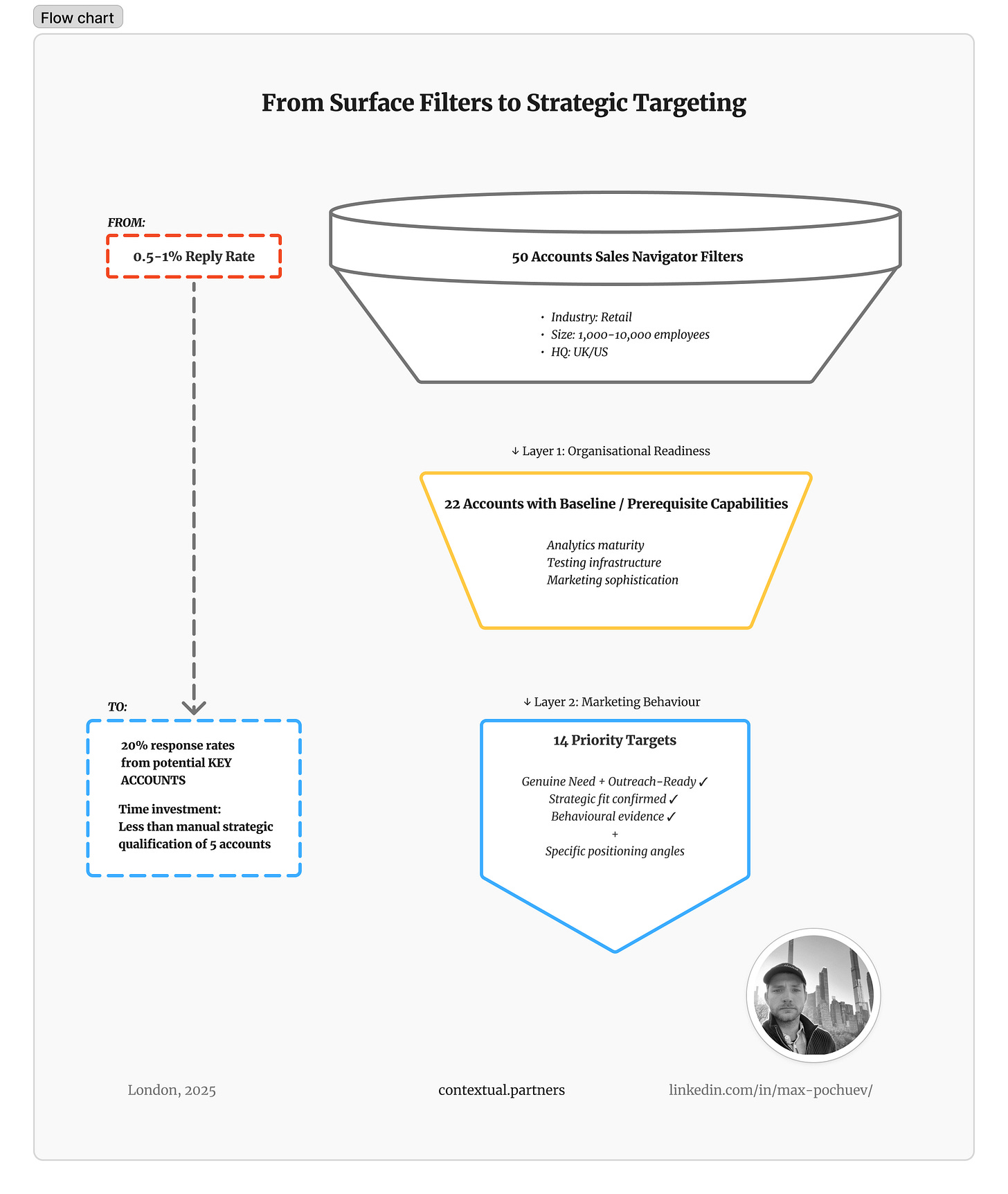

When I start working with new BD teams, leaders are typically forced to pick: spray-and-pray outreach based on surface-level filters, or manual qualification for criteria that actually matter to their service offerings—spending hours to identify real targets.

For strategic partners, spray-and-pray outreach now generates 0.5%-1% positive reply rates. This doesn’t work when only 500 accounts across the globe would find your positioning as a competitive advantage and can become a key account.

At the same time, contacting the right stakeholders, at the right account, with the right message at the right time requires:

Domain expertise—meaning it can’t be outsourced

Time for strategic qualification

Continuous updates to ensure relevancy and the best way in

The bottleneck to generating engagement from your target accounts with proactive tactics isn’t that your team lacks strategic knowledge about who needs your services.

The bottleneck is translating this clarity into operational workflows and applying them systematically across hundreds of accounts.

This post walks through how to translate domain expertise into systematic qualification.

Using a creative effectiveness testing agency as the example, I’ll show how their qualification principles identified 14 targets with genuine need—out of a sample of 50 companies matching Sales Navigator filters—with specific angles to approach, increasing response rates to 20%.

The Operational Bottleneck

Let’s take an agency specialising in predictive creative testing using emotional response measurement. Their BD leaders know exactly what makes a company a good fit:

Strategic marketing behaviour: Balancing brand building with performance. Investing in emotional creative beyond pure direct response. Making campaign-based decisions where testing delivers ROI.

Organisational readiness: Analytics maturity, testing infrastructure, and marketing sophistication to adopt predictive methodology.

Market context for positioning: Recent campaigns to reference. Marketing strategy on brand building and creative effectiveness. Strategic priorities that create timing and entry points.

These qualification criteria are specific to this agency and don’t live in Sales Navigator. They require cross-referencing multiple data sources—ad creative execution, media buying patterns, organisational structure, campaign activity.

Their experienced BD people spend 2-4 hours per qualified account synthesising these sources to make confident qualification decisions.

The challenge: domain knowledge that lives in senior BD people’s heads needs to become operational and be applied across hundreds of accounts while maintaining decision making quality.

Based on 50 initial accounts, a systematic qualification workflow identified 14 priority brands with specific evidence and complex decision-making applied to each stage—in less time than manually qualifying 5 accounts.

Translating Domain Expertise into Systematic Qualification

The qualification layers that follow are specific to creative testing, but the methodology transfers to any agency domain where you know who genuinely needs your expertise. If your agency has strategic clarity about client fit—you can articulate what organisational readiness, behavioural signals, and market context indicate genuine need—this systematic approach can be applied.

The prerequisite isn’t special data access or AI tools, but confidence in what patterns matter in your domain.

Layer 1: Assessing Prerequisite Capabilities

The first judgment: does the company have baseline capabilities to adopt your methodology?

For this agency, that means organisational infrastructure—analytics roles, data science teams, and testing infrastructure. They review org charts and individual profiles to evaluate marketing maturity.

Making this assessment manually takes 20-30 minutes per qualified account.

This video shows how the entire layer—including scoring across analytics maturity, marketing infrastructure and nuanced decision-making specific to this agency—translates into a qualification workflow that evaluates accounts systematically.

Out of 50 accounts matching Sales Navigator filters [Industry: Retail; Size: 1,000-10,000 employees; HQ: UK/US], only 22 had baseline infrastructure for these services to be adoptable.

Layer 2: Detecting Behavioural Signals of Strategic Need

The second judgment: what behavioural signals reveal genuine strategic need for your services?

For this agency, that means understanding marketing sophistication through multiple data sources—Meta Ad Library for creative approach, media buying data for channel investment patterns, top-performing ads for production quality and messaging strategy.

Each source reveals different aspects of strategy. But based on their experience, checking one source alone creates misleading signals—companies that look like poor fits can be strong prospects, while high advertising spend doesn’t always indicate strategic sophistication.

Their BD people cross-reference these sources to answer strategic questions: Is low performance paired with sophistication elsewhere? Is high spend in brand building or promotions? Does creative execution match investment?

Cross-referencing data takes 1-2 hours per account manually. Synthesising to detect patterns and make qualification decisions takes another 30-45 minutes.

This video shows how multi-source analysis and nuanced judgement—checking each source independently, then synthesising to detect strategic patterns and contradictions—translates into a structured system that classifies companies based on their actual marketing behaviour.

Out of 22 organisationally-capable accounts, systematic behavioural synthesis identified 14 brands whose marketing behaviour indicated genuine need for creative testing services. Each classification came with specific evidence and reasoning.

Layer 3: Gathering Context for Personalised Positioning

The third judgment: what context enables personalised positioning for qualified accounts?

For this agency, that means company-specific research—recent campaigns to reference in outreach, leadership interviews revealing testing philosophy, press releases showing strategic priorities and timing signals.

Browsing AdWeek, Cannes Lions and LinkedIn and synthesising research manually takes 1-2 hours per qualified account. Let’s see how this bespoke intelligence can be operationalised.

Systematic research gathered this context for all 14 qualified brands—recent campaign details, leadership perspective on creative effectiveness, current strategic priorities. Qualification decisions became outreach-ready positioning.

The complete systematic workflow assessed 50 accounts in the time their team previously spent manually qualifying 5. Each of the 14 priority brands came with specific reasoning explaining strategic fit and context about their marketing approach.

Senior BD time shifted from cross-referencing data sources or sending generic templates to everyone to applying insights: crafting positioning for qualified accounts informed by evidence of why each company needs their expertise and what makes outreach timely.

From Spray-and-Pray to Strategic Engagement

The creative testing agency example demonstrates a fundamental shift in how BD operations can work.

When qualification becomes systematic, BD teams stop spending the majority of their time gathering and cross-referencing data. That time allocated to what actually drives pipeline: crafting positioning for qualified accounts that demonstrates understanding of their specific situation and building relationships.

The agency’s 20% response rates came from contacting fewer companies with better understanding of why those companies needed their specific expertise.

For your agency, the qualification layers will differ. The data sources you cross-reference will be specific to your domain. But if you can articulate what organisational readiness, behavioural signals, market context, and other criteria specific to your ICP indicate genuine need—those patterns can be systematised.

For some agencies, services become relevant around specific events—like M&A branding expertise becoming critical when organisations announce integration initiatives—so on top of strategic qualification you need to implement trigger monitoring workflows. If your domain works this way, read my other post about systematically catching strategic triggers that signal timing for engagement.

Scaling Agency Prospecting: Why Strategy Must Come Before Tools

Your best BD people already know which signals indicate client need for your services.

Does your BD team’s domain expertise stay locked in senior’s heads and manual processes, or does it get embedded into workflows that can be applied across your entire target market?

My work focuses on translating agency domain expertise into systematic qualification workflows. If you have clarity on companies that find your expertise as a competitive advantage and want to explore what a qualification workflow could look like for your specific domain—get in touch. I’d be happy to share thoughts on how your strategic knowledge can translated into operational BD process.